Kansas law requires that we collect interest on your overpayment, which over time will increase the amount you must repay. It is to your advantage to repay overpayments as soon as possible. In addition, any state tax refund you may be due will be applied to the overpayment in each year an overpayment remains. Learn more about Form 1099-G and how it affects your taxes. Select the available appropriate format by clicking on the icon and following the on screen. If youve received unemployment compensation or a state tax refund, youll receive Form 1099-G. The documents found below are available in at least one of three different formats (Microsoft Word, Excel, or Adobe Acrobat. This means you will be without unemployment benefits until the overpayment is paid back. The Departments Common Forms page has centralized all of our most used taxpayer forms for your convenience.

If you are still claiming benefits, your overpayment will be deducted from your weekly unemployment payments until the overpayment is repaid. You may pay it back in a lump sum, or you can request a payment plan to pay overtime. If you believe that the notice is incorrect, you have the right to appeal. Claimants who received PUA benefits will have a separate 1099. These forms will be mailed to the address that DES has on file for you. Anyone who repaid an overpayment of unemployment benefits to the State of Arizona in 2021 will also receive a 1099-G form. If you received a 1099G form and you did not file for or collect unemployment benefits, please report this to us immediately. You may repay it in a lump sum or by making payments. DES has mailed 1099-G tax forms to claimants who received unemployment benefits in 2021. You may contact the Asset Recovery unit at (785) 296-3609 to make arrangements to repay an overpayment. If it is determined that a claimant received more money than they were entitled to, their case is turned over to the Asset Recovery unit to collect the debt. The previous years Form 940 is due to the IRS by. The form is required if you paid wages of 1,500 or more to employees in a calendar quarter, or if you had one or more employees for part of a day in any 20 or more different weeks in the last two years.

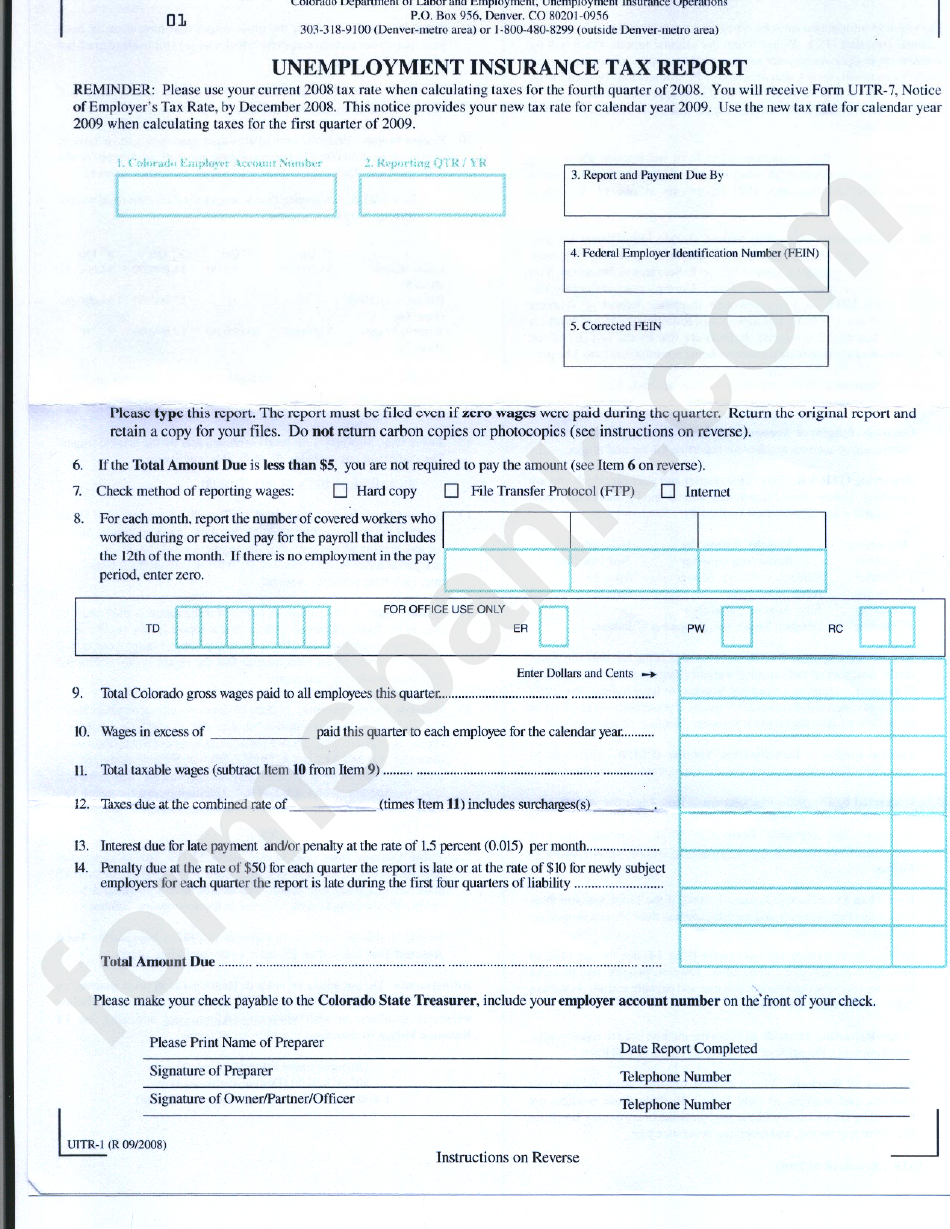

UNEMPLOYMENT TAX FORM HOW TO

If an overpayment has been established, we will mail a notice of determination explaining how the overpayment occurred, the amount overpaid and how to repay the amount due. IRS Form 940 reports an employer’s unemployment tax payments and calculations to the IRS. When a potential overpayment is detected, we may ask you to provide information as we investigate. If you receive benefits you are not entitled to, you are required to repay the benefits, even if someone else made the mistake that caused the overpayment.

Experience tax currently capped at 5.4 (RCW 50.29. This taxable wage base is 62,500 in 2022, increasing from 56,500 in 2021. Industrial Safety and Health Expand Industrial Safety and Health State Unemployment Taxes (SUTA) An employee’s wages are taxable up to an amount called the taxable wage base, authorized in RCW 50.24.010.Public Employer Employee Relations Act (PEERA) Decisions

UNEMPLOYMENT TAX FORM PROFESSIONAL

Professional Negotiations Act (PNA) Decisions Workers Compensation Expand Workers Compensation The IRS and some states consider unemployment compensation to be taxable income, that you are required to report on your federal tax return.

0 kommentar(er)

0 kommentar(er)